tax benefits of retiring in nevada

No Personal Income Tax. Youll Likely Pay Less in Taxes.

How To Plan For Taxes In Retirement Goodlife Home Loans

In fact the state has no taxes on income or Social Security benefits.

. Ad Make the most of these top retirement nests all across the US. The Silver State wont tax your pension incomeor any of your other income for that matter because it doesn. Ad Dive Into Core Questions on Social Security Benefits With AARPs Resource Center.

Nevada has warm weather desert air beautiful golf courses world-class spas outdoor activities affordable housing and no state tax and no inheritance tax. No tax on issuance of corporate shares keeps more cash in your pocket. Kiplinger ranked Nevada the 25th best state for retirees.

No personal income tax. Residents of Nevada are not assessed a state income tax. Not only does Nevada have relaxed gambling laws but also some of the best tax benefits for retirees.

Nevada is extremely tax-friendly for retirees. If you have you lost your interest in deciding a post-retirement were here to help you. No succession or inheritance with IRS which keeps more cash in the pockets of your successors andor heirs.

This includes income from both Social Security and retirement accounts. In the top 10 of states according to data from NOAA. The reason for this ranking is the higher cost of health care and cost of living.

The current state sales tax is 685 percent with. Ad Due to the new tax laws relocating to Nevada could have many tax advantages. Learn How Much You Will Get When You Can Get It and More With the AARPs Resource Center.

Since Nevada does not have a state income tax any income you receive during retirement will not be taxed at the state level. No corporate income tax. Technically the Las Vegas sales tax rate is between 8375 and 875.

Our Rule of Thumb for Las Vegas sales tax is 875. Nevada has far more sunny days and lower humidity to enjoy them than most states. Even if you are required to source part of your income from a state that has an income tax you may still benefit from a significant reduction to your overall tax burden.

California will tax you at 8 as of 2021 on income over 46394. Download our checklist to learn about establishing a domicile in a tax-advantaged state. No requirements of shareholders directors to live in Nevada.

You will usually pay less in taxes in nevada compared to other states. Not to mention its a short flight or drive from California. Nevada offers an abundance of tax advantages for relocating home and business owners alike including.

Considering the national average is 100 retirement here is going to cost more than some other states. According to Sperlings Best Places the cost of living index in Nevada is 102. Is Nevada tax-friendly for retirees.

No Taxes on Corporate Shares. Take 3 Minutes To Learn How To Boost Your Retirement Savings. State sales tax is 685 but localities can increase that to 81.

Top Reasons to Incorporate in Nevada. According to Zillow the median home value in Nevada is 291800 While that may still. 5 Good Reasons to Retire in Nevada 1.

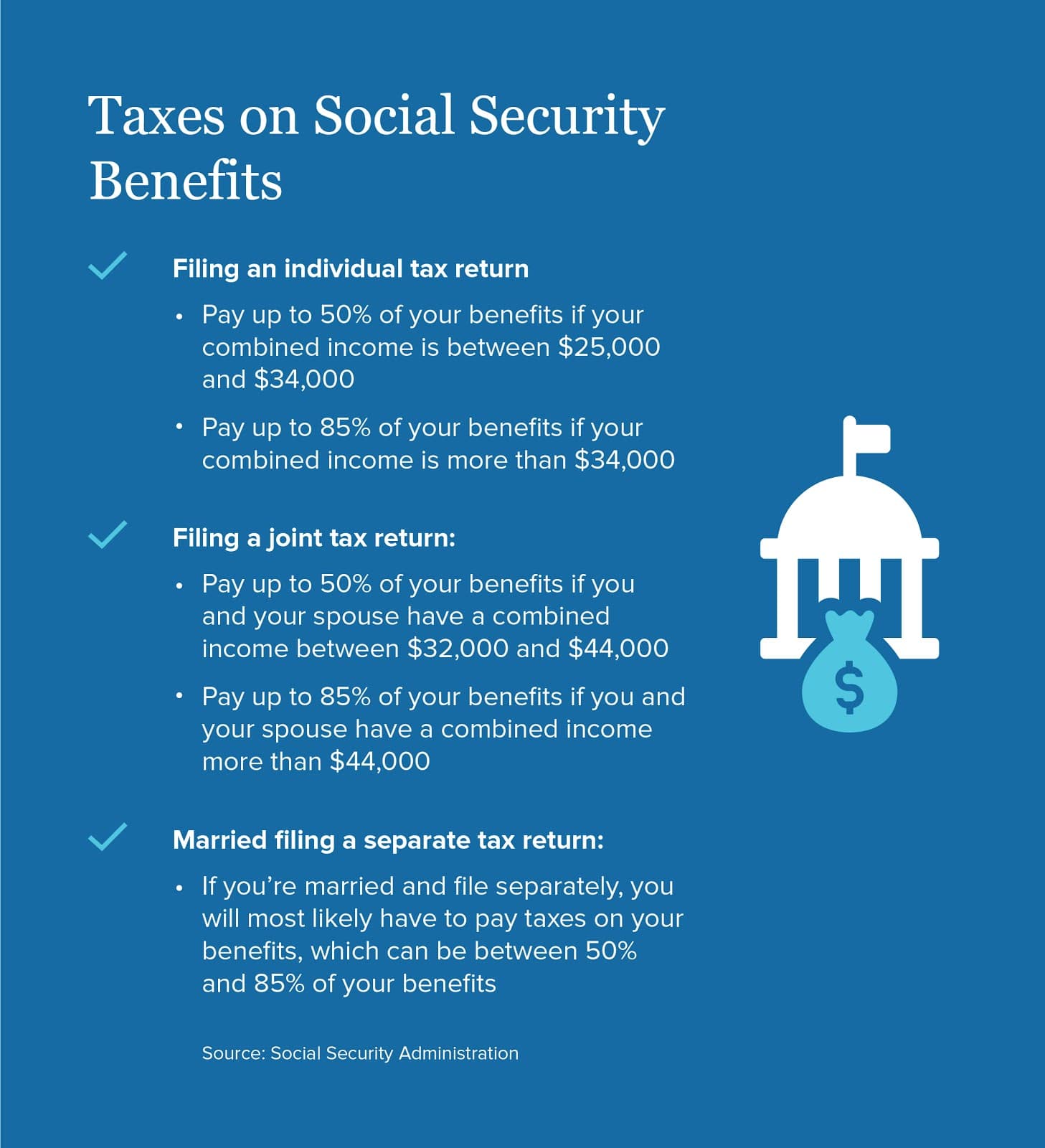

Ad Read this guide to learn ways to avoid running out of money in retirement. Social Security and Retirement Exemptions. At 83 Total tax burden in Nevada is 43rd highest in the US.

No gross receipts tax. The lack of income tax is a huge benefit but wait. Nevada is a low-tax paradise.

Thanks to all of the tax revenue flowing to the state from the casinos and tourism Nevada currently offers residents of the state a low overall tax burden compared to most. No Franchise Tax. The State of Nevada sales tax rate is 46 added to the Clark County rate of 3775 equals 8375.

Withdrawals from retirement accounts and public and private pension income are also not taxed whatsoever. Additionally the City of Las Vegas charges 05 city sales tax the City of Henderson also charges their sales tax percentage. Nevada corporations may issue stock for capital services personal property.

29 on income over 440600 for single filers and married filers of joint returns 4 5. Benefits of Retiring in Nevada 1. Nevada corporations may purchase hold sell or transfer shares of its own stock.

Nominal Annual Fees. The state offers a myriad of recreational activities. Tax Benefits Of Retiring In Nevada.

People who live in Nevada typically pay more for groceries healthcare and transportation than the average consumer. If you have a 500000 portfolio get this must-read guide by Fisher Investments. You know you want to.

They are not taxed. If youre looking for a tax-friendly retirement Nevada is one of the places to be. Nevadans also dont pay sales tax on home sales food medicine and other items.

No tax on sale or transfer of shares which keeps more cash in your pocket. Hunting is a favorite pastime of many residents. All of that savings adds up especially with home sales.

No Corporate Income Tax. Retirees in Nevada are always winners when it comes to state income taxes. Low Cost of Living.

Additionally the average effective property tax rate in Nevada is just 053. Nevada has no income tax. Ad Begin Saving For Your Retirement Today - Your Future Self Will Thank You.

For taxed items the sales tax rate sits at 46 plus local taxes which can reach a total of 8265 at the highest. No nevada inheritance tax after 3 years of residency. 323 on all income but Social Security benefits arent taxed.

Marginal Income Tax Rates.

Monday Map State Income Taxes On Social Security Benefits Social Security Benefits Map Social Security

Hotel Pools In Las Vegas In 2021 Las Vegas Hotel Pool Daylight Savings Time

Best States To Live In Retirement

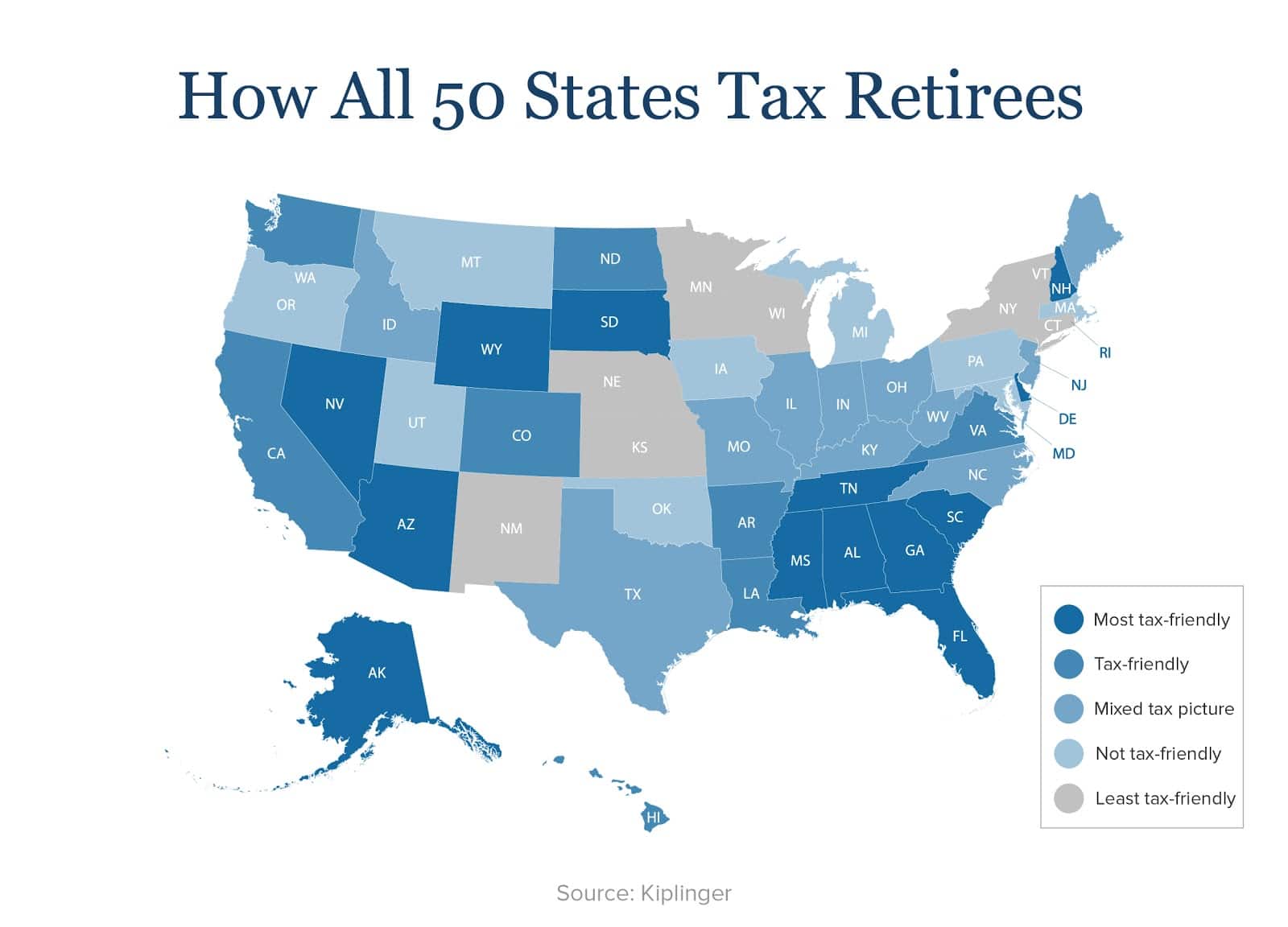

How Every State Taxes Differently In Retirement Cardinal Guide

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

How To Plan For Taxes In Retirement Goodlife Home Loans

The Most Tax Friendly States For Retirees Vision Retirement

States That Don T Tax Retirement Income Personal Capital

37 States That Don T Tax Social Security Benefits The Motley Fool

37 States That Don T Tax Social Security Benefits The Motley Fool

Nevada Tax Advantages And Benefits Retirebetternow Com

Nevada Retirement Tax Friendliness Smartasset

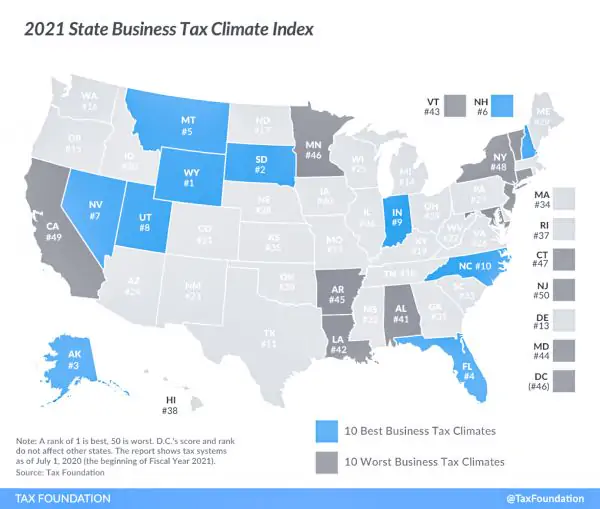

State By State Guide To Taxes On Retirees Kiplinger Retirement Advice Retirement Tax

Moving Out Of State Don T Forget About The Source Tax Mullin Barens Sanford Financial

How To Plan For Taxes In Retirement Goodlife Home Loans

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

10 Pros And Cons Of Living In Nevada Right Now Dividends Diversify

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)